Executive Summary

As lending executives and consultants, we’ve spent a combined 25 years serving Small Businesses, particularly focusing on providing financial products like credit cards, loans, and banking services. Throughout our journey, one aspect has proven to be game-changing but challenging: underwriting Small Businesses (SMB) in an accurate, automated manner.

Over the past decade, this field has seen an explosion of innovation, with groundbreaking advancements in data sources, API technology, machine learning, digital onboarding, and instant decisioning. Initially driven by larger banks, these innovations have now been embraced and implemented at scale by fintech companies.

In this article, we want to take you on a journey of how the SMB lending category has transformed over time, explore the emerging ecosystem of new technologies and data sources, and discuss how executives at banks, lending institutions, and payments companies can rapidly improve upon their current SMB offerings.

*Methodology: See End of Article

Decoding Success: Fintech v Traditional Methods

So, what’s the secret sauce that will allow banks and fintechs to thrive in this space? The truth is, the world of Small Business Decisioning used to be somewhat neglected. It was characterized by ineffective consumer technology and inefficient commercial workflows. But fintechs changed the game.

For executives running businesses in this arena, the innovation is both exciting and frustrating. Fintechs seem to have cracked the code, but how can traditional institutions get in on the action? Many have tried and encountered roadblocks along the way:

“Business data doesn’t appear significant in my model.”

“My compliance department won’t approve the use of this data.”

“My risk department lacks trust in this new approach.”

“My technology provider doesn’t offer an API for that data source.”

“Building this will take too long, about two years.”

“My model governance group will be overwhelmed if I bring this up.”

Sound familiar? We’ve heard these concerns time and time again. But the key lies in understanding how fintechs and traditional financial institutions view the world differently.

Fintechs use telescopes. They see stars and endless possibilities. But also emptiness. To gain traction, they efficiently focus on solving specific niche problems, unburdened by existing infrastructure. They embrace highly distributed decisioning models, where data is utilized at every step. Fintechs build their entire business infrastructure in a matter of months and overhaul it after each funding round.

Banks, on the other hand, use microscopes. They possess extensive infrastructure built over decades, complete with long value chains and constraints. When adopting new decisioning technologies, they tend to apply them to a single decision point, within a single team, on a single platform. Decisioning in large financial institutions is highly regulated, and data is used narrowly in a centralized manner. Unfortunately, this narrow approach often falls short.

For banks and other established organizations to thrive in this data-rich era, they must recognize the success of fintechs. They have mastered the art of viewing the entire value chain as a digital realm intertwined with data and decision-making. Embracing this perspective, banks can leverage their substantial resources and scale to seize this opportunity. However, they should be strategic in prioritizing their efforts, while building towards long term business objectives. In the final section of this article, we provide a practical roadmap for how to get there.

Navigating the New Data Sources

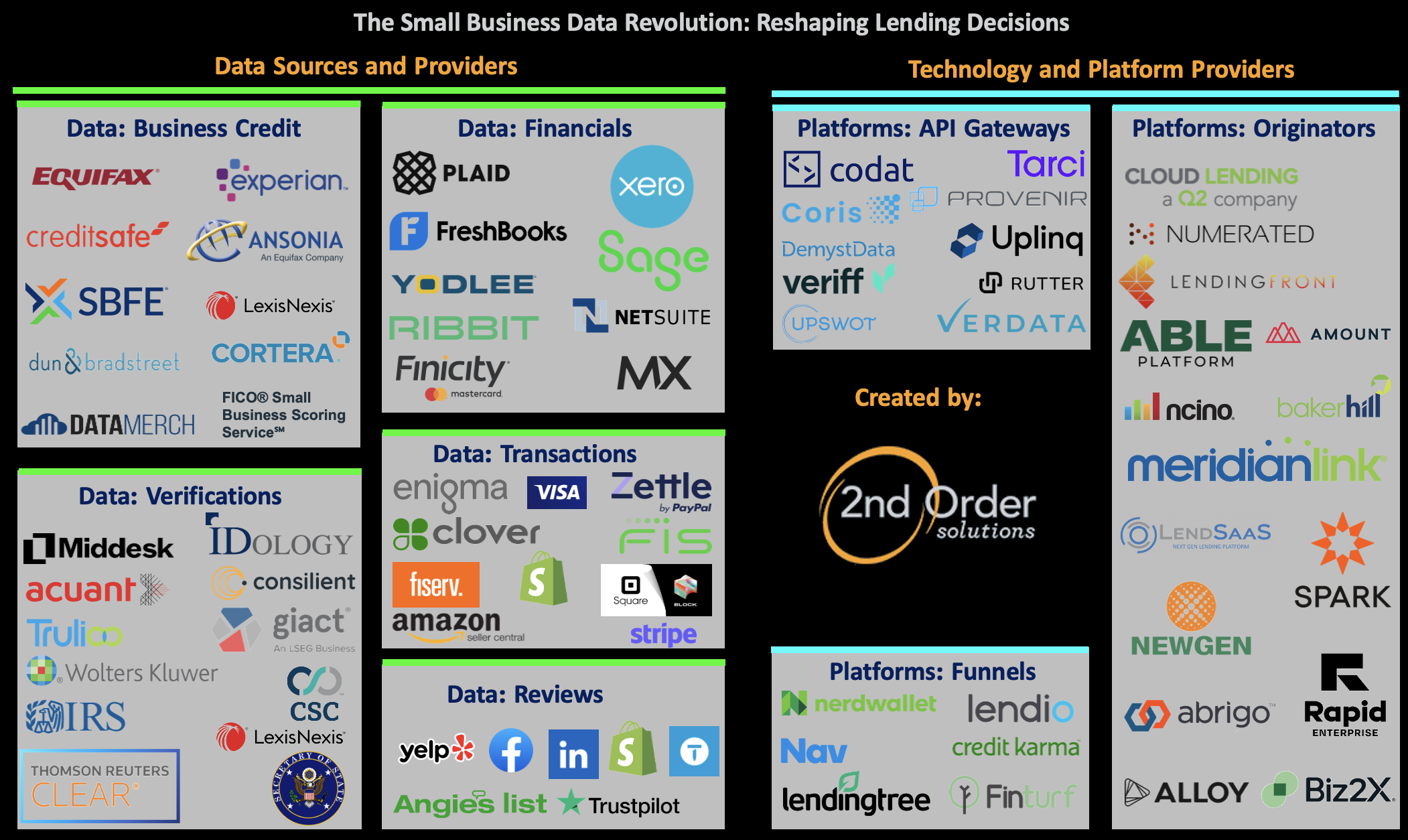

Central to the innovation in Small Business Decisioning is the rise of new data sources and the supporting ecosystem of technologies to access and utilize this data. To make sense of these sources, we need to understand the challenges they aim to address:

Verifications: Assessing Legitimacy and Risk

Before you even start to underwrite a small business, it’s important to answer questions about the business’s legal existence, legitimate purpose, compliance with regulations, tax payments, prior pledging of assets and the authorization of individuals involved. Financial institutions have been urged by regulators like FINCEN to adopt new data sources for this purpose. New innovations are constantly emerging like Consilient that utilizes Federated Learning Models to help institutions detect and prevent financial crimes more effectively.

Credit: Evaluating Business Creditworthiness

Credit evaluation plays a vital role in deciding whether to approve a business. This area is familiar to banks, drawing parallels from consumer credit assessment. Factors such as previous credit issuance, credit management, proportionality to assets/income, and signs of distress are considered. It’s important to note that not all business credits are reported to traditional credit sources, which may limit the scope of available data, especially for less-established businesses.

We believe that this area is at the forefront of innovation in the small business space. It is crucial for executives of large incumbent organizations serving small businesses to understand and adopt these data sources. Established organizations like Dun & Bradstreet and LexisNexis have been collecting and reporting on businesses for decades, but they have increasingly transitioned to support real-time API-based applications. Even existing consumer bureaus such as TransUnion, Equifax, and Experian, along with FICO, have expanded their offerings or acquired companies in this field. Newer SMB data sources like SBFE, Cortera, Ansonia, and DataMerch have emerged and become established players. Additionally, industry groups like The Small Business Finance Association have created private bureaus.

Financials: Understanding Business Performance

The financial statements of a business have long been a significant part of loan underwriting in small business lending. Traditionally, banks would review paper or PDF income statements and balance sheets in a process known as “spreading.” However, cloud-based accounting platforms and open-banking initiatives have transformed this process. Digitization enables more accurate insights into a business’s true income statement and cash flows, particularly through direct access to bank account data.

Transactions: Analyzing Customer Interactions

Examining how a business interacts with its customers provides valuable insights at a granular level. Beyond aggregated sales transactions, accessing individual sales data through merchant providers, ecommerce platforms, or aggregators offers a deeper understanding of a business’s performance. While companies like Square have built lending decisioning platforms on this concept, the potential of transaction data extends far beyond the merchant industry, presenting broader applications.

Reviews: Assessing Customer Perception

Customer reviews and social data can be a valuable source of information when evaluating a business. Platforms like Yelp and Angie’s List have made it possible to gauge customer sentiment and product quality using social ratings and even tools like Google Streetview. For businesses, especially those in industries where ratings are essential, such as restaurants, these reviews can serve as a verification of their existence and performance. The absence of ratings for an established restaurant, for instance, could raise a fraud flag warranting further investigation.

Incorporating these diverse data sources and leveraging their insights enables financial institutions to make more informed decisions regarding small businesses. By embracing innovations in verifications, credit evaluation, financial analysis, transaction data, and customer reviews, banks and lending institutions can enhance their decisioning capabilities and better support the needs of small businesses.

Bridging the Gap: Exploring Technology Partners in the new Decisioning Ecosystem

As data sources have proliferated, those most able to take advantage of them have been fintechs with native cloud-based technology platforms. Using new data sources was not just natural for them, but necessary for their digital first business models. Part of the evolution of this market has been the commercialization of this technology to make accessing and using data in decisioning easier.

Now, let’s talk about the technology partners that have emerged to bridge the gap between traditional institutions and the innovative ecosystem:

API Gateways: These platforms act as data supermarkets, aggregating multiple data sources and making it easier for banks to access them. They save time on engineering, third-party management, and contracting. Additionally, they often provide value-added layers such as models and scores to make the data more digestible.

Originators: Going beyond connecting institutions with data providers, originators take the application, extract the necessary data, run it through decisioning models, and provide reporting and workflows.

Funnels: These platforms integrate into the sales process, offering prequalified, digitized customers. They commoditize the entire customer acquisition experience, optimizing marketing and qualification processes.

Platforms: can be invaluable in helping institutions jumpstart their entry into the new decisioning ecosystem. Typically, more sophisticated institutions begin by leveraging APIs, while community banks and credit unions often opt for originators and funnels.

Technology partners can be helpful to get jumpstarted into the new ecosystem. Which combination of partners to use depends a lot on the institution’s capabilities and appetite for change. We have typically seen the most sophisticated institutions start with the API Gateways, and community banks and credit unions typically opting for Originators and Funnels.

Where to Start: A Practical Guide for Banks and Payment Executives

So, where should you start if you’re a bank or payments executive looking to tap into this new decisioning landscape?

- Create a Decision-Data Map: Map out every decision point along your customer’s journey, from marketing to application, decisioning, issuing, customer management, operations, and collections. Identify the data used at each point, its source (external, behavioral, customer-provided), and the platforms or API aggregators involved in processing and decision-making.

- Review available Decisioning Data Sources: Take the time to explore and understand the various data sources available in the industry. This article can serve as a starting point for your research. Pay attention not only to the data they provide but also to the methods of accessing it (APIs) and the platforms or API aggregators through which they are accessible.

- Conduct a Data Self-Assessment: Honestly evaluate the current state of your data and decisioning platforms. Determine how much of your existing infrastructure can be utilized or adapted to incorporate the new data sources and identify areas that may require replacement or augmentation.

- Create a Decisioning Roadmap: Develop a roadmap that outlines your desired data sources, as well as any API aggregators and platforms you intend to integrate. This roadmap should have a three-year timeframe and should be endorsed by both the business and technical architecture teams within your organization.

- Execute One Decision Point at a Time: Rather than attempting to transform your entire decisioning process overnight, it is often more effective to start with the decision point that offers the highest potential for impact and value. This is typically the approve/decline decision. By prioritizing decision points and gradually incorporating new data sources and technologies, you can navigate compliance requirements and ease your organization into the new decisioning ecosystem.

It’s important to note that this journey towards leveraging innovative data sources and decisioning platforms is an ongoing one. The landscape will continue to evolve, and new advancements and opportunities will arise. By having a clear plan, remaining adaptable, and staying attuned to industry developments, you can make significant progress and position your organization to embrace innovation as it emerges.

In conclusion, the world of small business decisioning has witnessed a remarkable transformation in recent years, driven by the innovation of fintech companies and the adoption of new data sources, API technologies, machine learning techniques, and digital onboarding processes. While these advancements present both opportunities and challenges for incumbent financial institutions, it is crucial for executives to understand the evolving ecosystem and embrace the power of data in their decision-making processes. By leveraging the right platforms, conducting a thorough assessment of available data sources, and strategically executing their decisioning roadmap, banks and payments institutions can harness the benefits of this fragmented yet innovative world of small business data.

*Logo Map Methodology: The logo map was created using our own experience in the space, as well interviews with industry experts and practitioners. For companies that had been acquired or rebranded, we used the name best known in the industry (whether legacy or new). For data sources, we included companies which provide or sell data, as well as those who may be authorized to provide data to a third party through a customers consent. Finally, the solutions that many companies offer are broad and cut across categories. We used our best judgment as how to categorize them based on what their core offering is. If you feel like your company has been left off or miscategorized, or for any other feedback on this logo map, please contact the authors.

About the Authors

This report was prepared by Mickey Konson and Dave Wasik.

Mickey Konson is a senior advisor at 2OS with 25 years global experience in financial services. He is a former senior executive at Capital One, and a Co-Founder of StreetShares, Inc., a small business lending technology company acquired by Thoma Bravo in 2022. He is passionate about technology-enabled delivery of financial services to consumers and small businesses, particularly in underserved segments. At 2OS he has served clients in Asia, Australia and the US. He also serves on the board of Accion-Opportunity Fund, one of the largest non-profit small business lenders in the US.

Dave Wasik is a partner at 2OS and former senior executive at Capital One with over 25+ years of experience in consumer and small business credit. At 2nd Order Solutions, he has led > 100 engagements spanning the full credit lifecycle with a particular focus on Small Business Lending, Collections and Loss Mitigation. Dave also led Capital One’s Small Business credit card business and was a Senior Credit Officers at the firm. He also led operations for a global microfinance organization providing credit to small businesses in developing countries.

You may contact the authors by email at:

About 2OS

2OS is a boutique credit advisory firm that provides credit risk consultancy services for clients ranging from top 10 banks to financial technology startups throughout the world. Our credit experts use groundbreaking data analysis and modeling techniques to deliver superior economic outcomes and sustainable competitive advantages for our clients.