Executive Summary

Recoveries (collecting on charged-off loans) is an important but consistently overlooked stage of the consumer credit lifecycle. Macro-economic events and the business cycle influence how lenders view Recoveries. During the benign portion of the business cycle, when losses are low and lenders focus on other aspects of credit, like acquisitions, Recoveries attracts little attention or investment. However, when the business cycle turns and deteriorating macro-economic conditions drive a period of elevated losses, lenders are left with little time and few choices to optimize Recoveries to perform well through a downturn. Sub-optimal Recoveries performance during a downturn results in an inability for Recoveries operations to manage higher inventories of losses which ultimately pressures lenders’ loss rates and earnings.

During the pandemic, consumer stimulus led to lower credit losses and therefore less of a strategic focus on Recoveries. As the U.S. enters a more challenging macro-economic environment characterized by inflation, interest rate increases, and resulting pressure on consumers, we are seeing losses increase back to pre-pandemic levels and even worse for some segments. Now is a perfect time to revisit Recoveries and refresh your strategic and operational approach. This paper will explore how the industry has evolved since the last economic downturn, provide an updated view of winning strategies, and highlight what is at stake for your organization. Our recommendations will provide insight that can help ensure your strategy is up to date with the latest advancements in inventory management, digital transformation, operations, and regulations.

We hope this paper will lead to a reassessment and sharpening of your current Recoveries strategy.

Recoveries Strategy Revisited

- Revisiting post-charge-off recoveries begins with inventory management

- A robust and efficient inventory management approach is the strategic backbone of an effective Recoveries function. Inventory management is the decisioning logic that determines which treatments charged-off loans will receive, in what order, and for how long. At a minimum, issuers should ensure their strategy utilizes a diverse array of component operations, coordinated to manage the flow of charge offs through Recoveries. The component operations should include a combination of internal staffing, 3rd party agencies, legal firms, and debt buyers. However, there are many nuanced details of revenue, cost, and compliance impacts that must be assessed when determining how the component parts connect. With foresight and diligence, a well thought out inventory management strategy can become a significant advantage to an issuer’s bottom line through a downturn.

- Component operations defined

- Internal operations: includes lender employees that focus on inbound / outbound phone, text, email, and letter channels.

- 1st party outsourcing: resources belonging to external suppliers, hired on behalf of the lender, that perform as if they were the lender’s internal employees, using the lender’s systems, and representing the lender’s brand.

- 3rd party agencies: resources belonging to external suppliers, hired on behalf of the lender. Perform similar functions as the lender’s internal employees but use their own systems and represent themselves as employees of the agency, not the lender. There are also 3rd parties that specialize in functions like bankruptcy processing, estates, etc.

- Legal firms: external operators that will pursue legal options to recover on an account, including filing suit, obtaining a judgement, and using the judgement to recover funds through wage garnishment, asset liens, etc. Legal capabilities vary by state and legal firms may also engage in traditional inbound / outbound methods.

- Debt buyers: external operators that will purchase charged-off assets from the lender; debt sales can occur at any timeframe post-charge off that the lender chooses; an attraction to debt sales is lenders carry no ongoing costs while realizing an immediate revenue benefit from the assets sold.

- Defining the “objective function” of Recoveries

- Recoveries should be managed from a Profit & Loss perspective, with “revenues” from dollars recovered and expenses incurred to recover the funds. Since Recoveries often reports into a broad operations function whose leaders are incented on expense reduction, some lenders have a tendency to measure Recoveries performance based on expenses rather than dollars recovered. This is a flawed approach. Recoveries is a profit center and should be staffed and managed accordingly.

- Gross dollars recovered, or Recoveries “revenue,” is what impacts the lender’s portfolio loss rate. Furthermore, changes in Recoveries assumptions can have a massive impact on a lender’s loss reserve.

- Because of the incremental short- and long-term cash flows that come from a change in policy, strategy, or operational treatment, Recoveries decisions should be measured using an NPV-based framework. Having a discounted cash flow model to evaluate Recoveries strategies is critical, since different strategies have different payback periods and revenue/expense tradeoffs.

Evolution Since the Last Downturn

- Recoveries has not been top of mind for most issuers

- Most lenders have under-invested in their Recoveries operations over the past several years. Until recently, the industry saw a benign period characterized by low losses, lofty debt sale valuations, and high repayment rates driven by increased consumer liquidity. Pre-charge-off collections has been a much higher priority due to significant expense reduction opportunities, call centers transitioning to working from home, and digital transformation priorities. Most large banks and credit card issuers have not innovated within Recoveries because credit losses have been so low. Most fintechs lack a strong Recoveries strategy, since they are relatively young organizations that have not existed during a significant downturn. Even larger banks have pulled staff and investment dollars away from Recoveries during the period of low losses and are finding it difficult to re-establish it as a significant priority.

- Leading issuers have remained invested in optimizing Recoveries

- Leaders in the Recoveries space have maintained their level of investment, focusing on initiatives intended to improve digital capabilities, enhance customer experiences, and improve the profit impact of their Recoveries strategies.

- Key initiatives have centered around reducing reliance on outbound calls while increasing digital communications and inbound self-service capabilities. Digital Recoveries is emerging as a winner in terms of reducing credit losses, reducing operating expenses, and improving the customer experience. Lenders’ improvements in digital Recoveries have led to an increasing amount of in-house work, since more advanced lenders typically have more advanced digital capabilities than their outsourced agencies.

- During the Great Recession, the industry saw the rise of debt settlement companies (DSC). These companies offer an attractive proposition to consumers by consolidating debt and achieving discounted rates of payback. However, they effectively limit the right-to-collect for populations of payers from lenders, leading to a historically antagonistic relationship. Savvy Recoveries leaders have learned how to proactively engage debt settlement companies to unlock value and prioritize repayment on their loans.

- Recoveries leaders have also been diligent to revise strategies in response to recent regulatory changes. While not formally impacting creditors, many lenders with internal Recoveries operations have pro-actively adopted the updated Regulation F framework and reduced outbound dialing. Lenders also understand that reduced dialing by 3rd party suppliers will impede results. Increasingly, these lenders are working to crack the code on digital Recoveries to more than offset the reduced dollars recovered from lower levels of outbound calling.

Winning Strategies for the Next Downturn

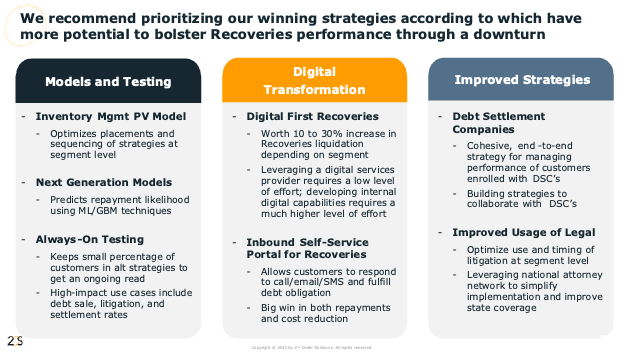

- We recommend a multi-faceted approach to updating Recoveries strategies:

- Recession Readiness: expand your network of agencies and debt buyer panels now; ensure adequate access to agent capacity and debt buyers, as macroeconomic pressures will lead to increased volumes of charged-off loans across the industry.

- Digital-first Recoveries: move to a digital-first approach for as much of the Recoveries experience as possible; leverage an omni-channel approach for outreach; ensure Recoveries systems can handle digital payments via portal; ensure digital initiatives are undertaken for both internal operations and outsourced agencies.

- Next Generation Models: upgrade and apply machine-learning (ML) techniques to liquidation models; expand model use cases to de-average the decision on whom to sue, sell, or work; dynamically update model scores after Recoveries entry using internal and external triggers.

- Accelerate Usage of Litigation: legal strategies to recover are resilient during a recession, but primarily for accounts already receiving legal treatment; courts have fixed bandwidth and this channel will become congested as charged-off inventories rise; stay ahead of the competition by increasing usage now such that accounts already in the legal stream will outperform through the downturn.

- Always-On Debt Sales Testing: develop debt sale ‘relief valves’ at all nodes of inventory management; conduct always-on sales of small test volumes of all types of charged off assets, e.g. fresh charge offs, post-primary, post-secondary, work exits, bankruptcies, etc; the always-on testing sets up the ‘relief valves’ allowing volume to quickly be channeled through whichever sale is yielding the highest value.

- Debt Settlement Companies: ensure there is a collaborative relationship with DSCs; work with them to pro-actively identify their inventory and exclude those populations from work and sales strategies; automate interactions with DSCs through bulk settlement; ensure accounts that break DSC settlement plans are fed back into the Recoveries workflow.

What is at Stake

- Observations from the last recession have informed our valuations

- Our valuations assumed recession conditions reflecting both increased charged-off inventory and degradation in liquidation performance for most core Recoveries strategies. These assumptions were grounded on observations from the last recession, where the significant increase in charged-off volumes overwhelmed agencies. Unworked paper eventually flooded the debt buyer market, resulting in a cratering of sales prices. Liquidation rates on most Recoveries strategies also dropped, but to a lesser degree, and legal liquidation rates were surprisingly resilient with just a slight deterioration in performance.

- We estimate significant upside through our recommended strategies

- Each of these strategies has the ability to make a meaningful impact on Recoveries revenue. If implemented in aggregate, we conservatively estimate that a Recoveries operation can realize a 15-30% increase in revenue through a downturn.

Conclusion

- Now is the time to take action

- As economic conditions continue to deteriorate, the time to prepare for adverse events is being reduced as time goes on. Our recommended strategies can deliver value, but they take time and staffing capacity to implement. They also take expertise to customize, sequence, and match to an issuer’s unique Recoveries needs. Marshalling resources and refreshing your Recoveries strategy now gives the best chance to unlock significant value.

- A theme throughout this paper is taking a data-driven, segmented approach to Recoveries. 2nd Order Solutions brings a great deal of expertise to targeting the right strategy to the right segment, to improve Recoveries performance in all parts of the economic cycle.

- We lead with Digital-first Recoveries

- Of our winning strategies, we are uniquely situated to help lenders enhance their digital offerings by developing tailored, omni-channel servicing solutions that increase engagement and drive incremental payments. Through our partner Quanta Credit, we have the ability to more closely connect with our client’s customers via refreshed high-impact creatives, innovative analytics, and an understanding of how to deliver the right message at the right time through the right channel. We would love to learn more about your organization’s digital journey and how we can partner to elevate it to the next level.

Please feel free to contact us if you’d like to see some examples or additional details of anything we discussed during the white paper. We welcome the opportunity to discuss Recoveries with you in further detail!

About the Authors

Matt Jarrell – Head of Client and Enterprise Analytics at Quanta Credit Services and Senior Advisor at 2OS with 20+ years of experience in consumer credit and loss mitigation. Matt has led multiple engagements in Collections and Recoveries across top 10 banks, regional banks, and fintechs. Prior to joining Quanta Credit and 2nd Order Solutions, Matt led strategy teams at Capital One.

Dave Wasik – Partner at 2OS and former senior executive at Capital One with over 25+ years of experience in consumer credit. At 2nd Order Solutions, he has led > 100 engagements spanning the full credit lifecycle with a particular focus on Collections and Loss Mitigation. Dave also led Collections and Recoveries for Capital One’s card and personal loan businesses during the Great Recession and was one of a handful of Senior Credit Officers while at Capital One.

You may contact the authors by email at:

About 2nd Order Solutions

2nd Order Solutions (2OS) is a boutique credit risk advisory firm that specializes in solving the world’s most challenging credit problems. 2OS was founded 12 years ago and consults to a wide range of banks, card issuers, fintechs, and specialty finance companies in the US and abroad. 2OS has deep experience with lending businesses across Card, Auto, Small Business, and Personal Loans at all points in the credit lifecycle. 2OS partners have vast expertise in all aspects of Collections, both as operating executives and as consultants.

About Quanta Credit Services

Quanta Credit is a 1st party digital solutions provider that manages and elevates clients’ recoveries performance while also enhancing their brand. Quanta provides turnkey, integrated, digital outreach fulfillment across email and text. Quanta’s end-to-end strategic and creative solutions are digital-first and customized to its clients’ needs. It has proven results across a diverse spectrum of clients, including banks, fintechs, and non-bank lenders.